Introduction to GSTR2B on GST Portal

GSTR2B on GST Portal provides eligible and ineligible Input Tax Credit (ITC) for each month, similar to GSTR-2AÂ but remains constant for a period.

Moreover, GSTR2B is available to all the regular taxpayers. Every recipient can generate it on the basis of the GSTR-1, GSTR-5 and also GSTR-6 furnished by their suppliers. The statement will clearly show document-wise details of ITC eligibility.

ITC information will be covered from the filing date of GSTR-1 for the preceding month (M-1) up to the filing date of GSTR-1 for the current month (M). For instance, GSTR-2B generated for July 2020 will contain documents filed by their suppliers from 12 a.m. on 12th July 2020 up to 11:59 p.m. on 11th August 2020. Also, the statement for July 2020 will be generated on 12th August 2020.

Importance and benefits of GSTR 2B

The data in GSTR2B on GST Portal is reported in a manner that allows taxpayers to conveniently reconcile ITC with their own books of accounts and also records. It will help them in easier identification of documents to ensure the following:

- The input tax credit is not availed twice against a particular document.

- The tax credit is reversed as per the GST law in their GSTR-3B, wherever required.

- GST is correctly paid on a reverse charge basis for the applicable documents, including import of services.

- The statement indicates the respective tables or column of GSTR-3B under which the input tax credit of an invoice/debit note must be taken.

When was GSTR-2B made available?

GSTR-2B has been made available from August 2020 onwards. It can be generated by recipient taxpayers once a month on the 12th of the month next to the tax period. For instance, You can access GSTR 2B for August 2020 on 12th September 2020.

Further, the timelines for the generation of GSTR-2B is available on the government portal under the View Advisory tab.

How to access GSTR2B on GST Portal?

The following are the steps to access GSTR 2B, mostly available from 12th August 2020:

Step 1: Log in to the GST portal.

Taxpayer must use his/her credentials to login.

Step 2: Navigate to the Returns Dashboard.

Step 3: Select the relevant tax period.

Select the month and year.

Step 4: Click on the GSTR-2B tab.

Step 5: Click on the Download button to save the statement on your system.

How does ClearTax GST help with GSTR-2B?

ClearTax GST, a cloud-based software, provides an advanced reconciliation tool to quickly compare GSTR 2B with the purchase data, including the bill of entry.

ClearTax GST offerings for reconciliation of purchase data are as follows:

- A single-click import of the purchase data from Tally software

- In-built validations for accurate upload of the purchase data

- Advanced filters and excel report summary to take actions and maximise ITC claims

- Supplier-level invoice mismatches can be identifie for taking corrective actions

- Comparison report GSTR-2B versus GSTR-3B.

Contents and features of GSTR2B on GST Portal

The input tax credit on purchases from any regular taxpayers and non-resident taxable persons will be available. Further, the input tax credit distributed by the input service distributor shall also be available.

The contents of GSTR2B on GST Portal is as follows:

- Firstly, a summary statement showing ITC available and non-available for every section.

- Secondly, the advisory for every section clarifies the kind of action that taxpayers must take.

- Document-wise details such as invoices, credit notes, debit notes, etc. to view and download.

- Next, cut-off dates and advisory for generating and using GSTR-2B.

- Lastly, import of goods and import from SEZ units/developers (available from GSTR 2B of August 2020 onwards).

The input tax credit will be mark as not available in the following two scenarios:

- Where the time limit to avail input tax credit on an invoice or debit note has expired under section 16(4) of the CGST Act (earlier of 30th September of the year following the financial year or date of filing annual returns).

- The state of the supplier and place of supply is the same, whereas the recipient is located in another state.

The notable features of GSTR-2B are as follows:

- To view and download the summary statement as a PDF file.

- You can also obtain section-wise details or complete the download of ITC instantly.

- Next, the availability of section-wise advisory.

- Further, allows text search for all the generated records.

- Moreover, option to view, filter and sort data, as required.

- Hide/view the columns at the user’s convenience.

- Where the file contains more than 1,000 records, options for a full download of GSTR-2B and an advanced search is also available.

- An email or an SMS will be sent to the taxpayer informing them about the generation of GSTR 2B.

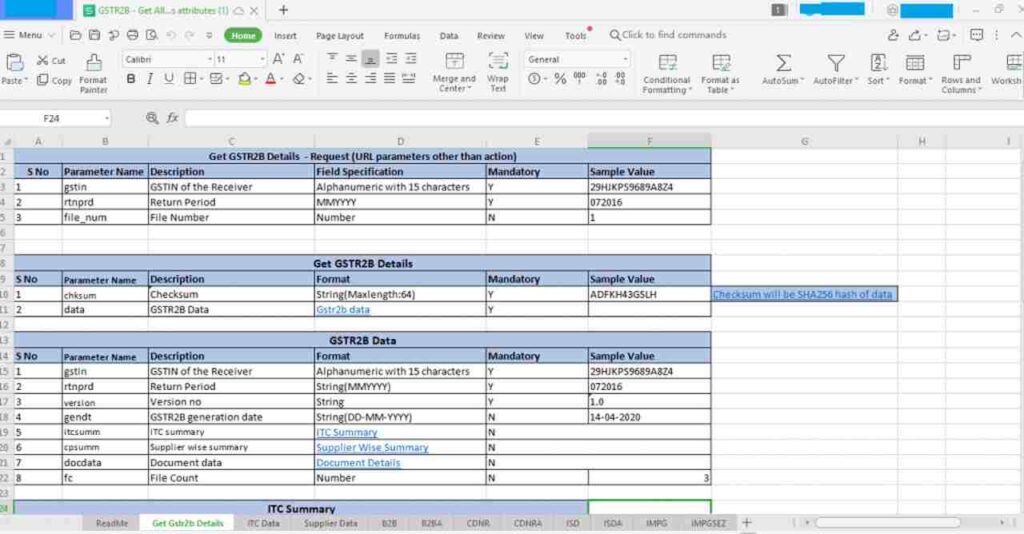

The detailed format of GSTR-2B

Heres a glimpse of a downloaded GSTR 2B:

To get the detailed template of GSTR-2B, click on Download Now?.

Comparison of GSTR-2A with GSTR-2B

GSTR-2A and GSTR 2B can be compare as follows:

| Points of Comparison | GSTR-2A | GSTR-2B |

| Nature of Statement | Dynamic, as it changes from day to day, as and when the supplier uploads the documents. | Remains static or constant, as the GSTR-2B for one month cannot change based on future actions of the supplier. |

| Frequency of Availability | Monthly | Monthly |

| Source of Information | GSTR-1, GSTR-5, GSTR-6, GSTR-7, GSTR-8, ICES | GSTR-1, GSTR-5, GSTR-6, ICES |

| ITC on Imports | Contains details of ITC of IGST available on imports (overseas and inward supplies from SEZ units/developers) flowing in from ICEGATE system to GST system | Contains details of ITC available on imports as obtained from ICEGATE system (Not made available) |

For expert advice

Address: C-8/13, Sector-7, Rohini, Delhi-110085

Call: +91-8882196405

Email: info@bpaeducators.com

Private Facebook group: BPA mastery

To get more updates join VIP COMMUNITY OF BPA EDUCATORS- https://www.facebook.com/groups/bpamastery/

Website: www.bpaeducators.com

Instagram: https://www.instagram.com/bpaeducator/

Facebook: https://www.facebook.com/bpaeducator

Twitter: https://twitter.com/EducatorsBpa

Youtube: https://tinyurl.com/y9nb27xc

Linkedin: https://www.linkedin.com/company/bpa-educators/